Chai Jijun, Co-Founder and EVP of Visual China Group (VCG) provided a very detailed and complete picture of the stock photo business in China when he gave the keynote address at the

DMLA 2016 Conference last week. The following is his presentation.

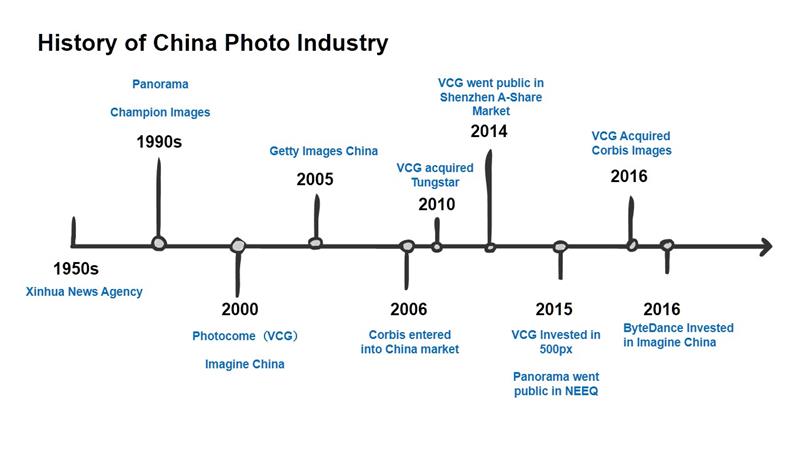

Chai started his presentation with the following slide that outlines a history of China Photo Industry.

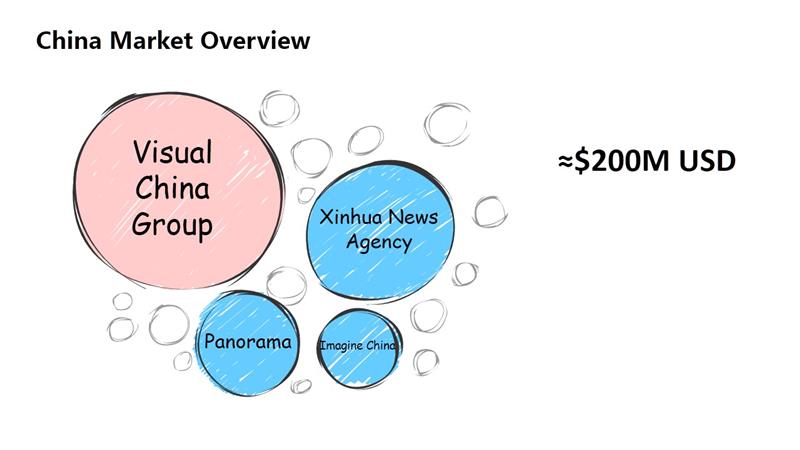

VCG occupies the largest market share in China, leading the way in both media and commercial market. Based on the annual report, our revenue in 2014 was about 65 million USD, including 40 million USD from licensing and related services. In 2015, our revenue reached 87 million USD, within which 60 million was from licensing related business. According to the 2016 semi-year report, licensing business contributes about 40 million USD.

Given the inherently government-backed advantages in editorial area, Xinhua News Agency is quite influential in media segment. Whereas, they hardly ever involve in creative and commercial market.

Panorama is in the first group of commercial photo agency in China. Therefore, it’s established brand influence on commercial side, but very few market share in media segment. According to their report, in 2013, its licensing business revenue was about 7 million US dollars; in 2014, the figure was 6 million. Last year, their total revenue was around 13 million US dollars, 53%, which about 7million USD was from licensing business and 45% was from advertisement.

Imagine China, just like VCG, is also a private company. It is quite competitive in editorial market. In this September, Bytedance, a Chinese mobile internet company, has just invested in them.

(Editors Note: Zan Kuang of Imaginechina who also attended the DMLA conference told me that their 2015 revenue was about 15 million USD.)

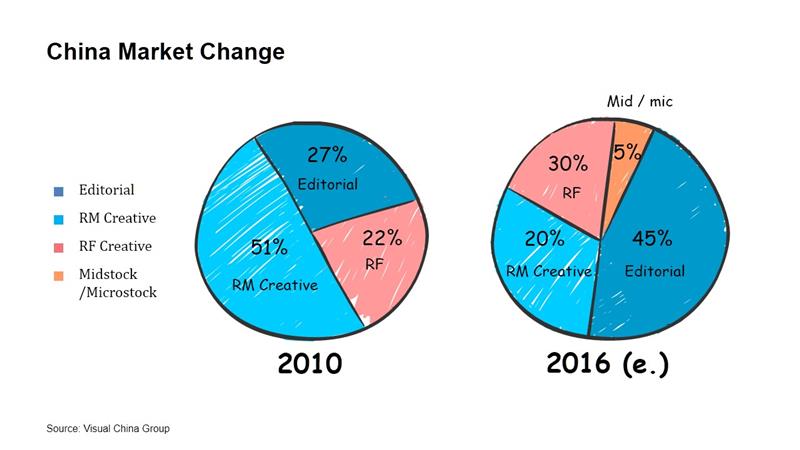

Different from global market, Midstock or Microstock has just started in China. But we did notice the trend. Two years ago, iStock and Shutterstock partner with VCG and Zcool respectively, launched localized e-commerce Microstock platform – Fotomore.com and hellorf.com. Meanwhile, many oversea Microstock websites has set up their Chinese version. Their low price and simple easy online payment methods has attracted some Chinese users, however, the user experience were not quite good due to the special internet environment and market features in China.

All in all, my personal estimation is that the current China image market worth about 200 million USD.

In 2010, the revenue percentage of Editorial, Creative RM and RF was respectively 27%, 51% and 22%. But in 2016, we predict the demand for Editorial and RF images will increase, whereas revenue from RM content will keep going down. Meanwhile, some customers start to use Microstock.

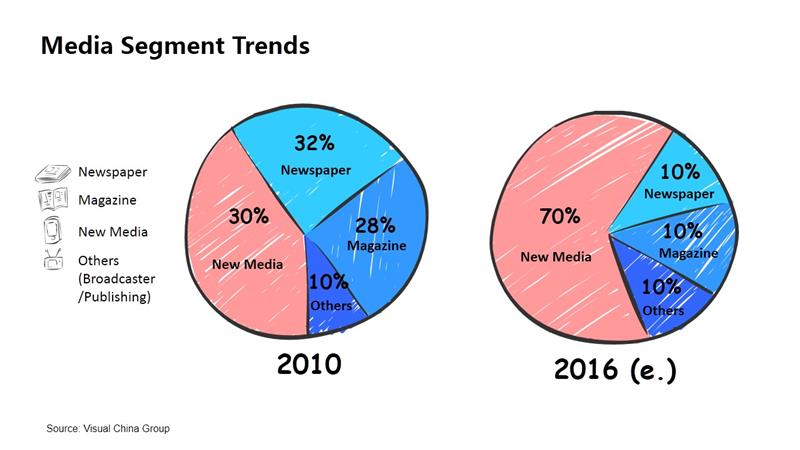

This slide is focusing on the editorial and media segment. As you can see in 2010, the revenue from new media, newspaper and magazine were basically the same. Since 2015, there has been a huge decline in traditional media, especially newspaper and magazine. In opposite, the revenue from new media has been increasing sharply due to the fast-growing internet industry in China. this year, our forecast is that the new media share will reach 70%.

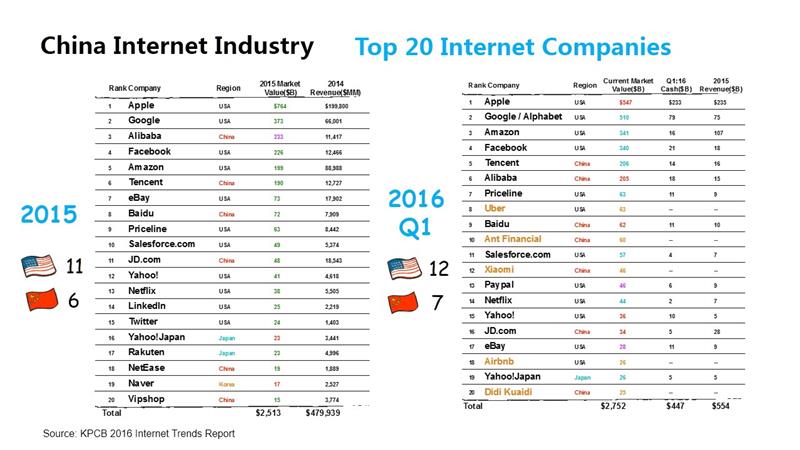

According to the latest Internet trends report from KPCB, these are the top 20 internet companies in the world in 2015 and 2016 Q1. As you can see, basically all the companies are from U.S. or China. I believe in the next three years, China and U.S. will still dominate the global internet market. In some ways, China has already surpassed U.S. Let’s take Apple Store for example. According to the report from App Annie, in Q3 this year, China’s Apple Store revenue was over 1.7 billion USD, surpassed U.S. for the first time.Why Chinese internet industry is developing so rapidly? I think there are three major reasons:

First of all, China’s internet is a closed and very special market. This makes most of the U.S. internet companies unable to compete with local enterprise. For example, in e-commerce sector, US has Amazon, China has Alibaba and JD; in transportation sector, US has Uber, China has DIDI; in terms of mobile internet payment, US has PayPal, China has Alipay, Wechat Pay; regarding social network, US has Facebook, twitter, China has Wechat, Weibo etc.

The second reason is the huge market and population. According to the latest report from CNNIC, China Internet Network Information Center, the number of China’s internet user has broken 700 million, in which 92.5% are mobile internet users.

The third reason is the poor condition of the foundation of China’s commercial service, that reflected in e-commerce, logistics, media and so on. The low productivity of state-owned enterprise actually gives private companies a huge opportunity to develop. For example, in media industry, the performance of commercial new media is far beyond the state-owned ones.

In terms of mobile internet, China also keeps a fast pace of development. This is the list of the largest smartphone manufacturers in the first quarter of 2016, sourced from IC insight report. As you can see, among the top twelve companies, eight are from China. Meanwhile, China is also the largest market for Apple.

Although Chinese mobile phone manufactures are more focusing on the mainstream market, priced from 100 to 500 USD. Next year, I believe Chinese companies, like HUAWEI and Xiao MI, will begin to challenge high-end market, competing with Samsung and Apple. Huawei, ZTE, Xiao MI, they are not only selling product in Chinese market, but also widely distributing to most of the world, covering Europe, Southeast Asia, India, and Africa etc.

Currently, mobile device has become the most critical traffic portal. For us, this is also a substantial opportunity for development.

Opportunities and Challenges in China Market

I spent a lot time talking about China’s Internet and mobile Internet. Why? Because I believe for the whole content licensing industry, the mushrooming of internet industry is a critical opportunity as well as a challenge. Especially in China.

Firstly, I’d to point out that the boom of Internet and mobile Internet in China brings huge amount of imagery use. Giant internet companies have tons of millions of users. On their platform, they need to provide various services for users, and the most important one is content service. Take WeChat for example, this super APP integrates functions of instant message, social, social media, payment etc. According to Tencent’s report, WeChat’s monthly users has reached 700 million and more than 90% of them use Wechat on a daily basis; 50% of them spend more than 1 hour per day. In Wechat, any media, organizations, corporates and even individuals can set up its own official account, tweeting text, pictures, video and music for marketing or communication purposes. 40% of its users, equals about 300 million people, getting the latest news & information from Wechat. According to Tencent, the number of Wechat official account has reached 10 million, organizations, corporates and brands account for 72.7%, within that 27.8% are entertainment and sports related. Let’s say only 5% of these official accounts pay for the image use of $300 USD a year. It would be an over 100million US dollars’ market. But the fact is, most of the official accounts currently are using unauthorized pictures, which is a big challenge as well as a huge opportunity for us.

Secondly, the boundaries between media and commercial are getting blurring. With the development of Internet and social media, corporates and brands could reach their audiences without using traditional media or advertising channels. Especially, Internet companies, in vertical fields of finance, entertainment, sports, female, mother & child care, tourism, health and automobiles etc., are rushing to establish their own in-house “new media content department” to creative targeted content for their users, to touch their audiences more frequently. For example, Taobao is the largest e-commerce platform in China. in 2016, they launched their own Taobao Toutiao which is a content-based promotion platform. Fashion bloggers or opinion leaders can post articles, pictures, videos on this platform for promotion purpose, and they will get a certain percent from sales revenue. Would this digital magazine become the next FASHION or VOGUE? There is a map service provider in China named Amap, just like Google map. But the difference is that Amp not only offer navigation service but also tweet relevant news to their users base on GPS positioning, such as car accident news, traffic updates and so on. In holidays, Amap will also provide high-quality travel guides to certain users. Maybe this mobile map application will become the next Nation Geographic. Like Taobao Toutiao and Amap, we could consider it as new media forms which bring huge amount of content demand especially editorial content. Meanwhile, native Advertising attracts more and more attention and we see more and more corporates are willing to invest in content

The third topic I’d like to talk about is piracy. Images on internet are much more easily to be copied and sent, piracy issue is extremely serious. It is a big challenge to content licensing industry, especially in China even though the overall environment is gradually improving. In China, unauthorized uses exist in many of our customers from fortune 500, public companies, and middle and small-size customers. The compensation for a single image ranges from 200 to 2000 USD. As the copyright environment and education standard improving, more and more customers are willing to establish long-term cooperation with photo agencies to get the licensed pictures. VCG UU team together with technical and professional legal partners using technologies like Image Recognition, Web Crawler and Tracking & Matching system to find piracy cases, preserve the evidence, then we communicate with potential clients or proceed lawsuit. Our work has received fully support from judicial and copyright management administrations. China's Supreme Court has also incorporated our win case into annual intellectual property case study for several times. VCG is also the first company in China using Digital Timestamp technology to preserve copyright evidence and the first one using this technology in judicial practice, which highly improved our working efficiency.

The last point I’d like to point out is the lack of local content. Most of Chinese photographers are focusing their shooting subjects on editorial, travel and landscapes. Their content is good. But if we look at People-related subjects, the high-quality creative content is basically from foreign photographers, especially those from Korean and Japanese supplies. This is a big opportunity for foreign photographers and production companies. For VCG, we are willing to partner with them to produce more high quality content.

VCG’s Development Strategy

I’d like to share our development strategy in the near future.

In the first place, VCG will keep focusing on the Chinese market. Our goal is to integrate the best content in the world and deliver it to our Chinese customers.

Based on that, VCG will further increase investment in technology. In the age of mobile internet, technology plays a critical role in delivering our products and services to meet different customers’ needs. It’s also the key to VCG’s business expansion from B2B to B2C.

We will make more investments in building industry ecosystem in local market. Focusing on Professional Generated Content, or PGC platform, such as VR/AR content and digital marketing companies and so on.

Last but not the least, we will leverage capital advantages to invest in vertical industries such as tourism and education, looking for diversified development.

In the past fifteen years, China photo industry has been growing rapidly along with the boom of Internet. In the next 10 years, China’s economy will transform from investment-driven to consumption upgrading driven as Chinese government has been strongly supporting cultural creative industry, including entertainment, sports, design and IT fields.

China is a very special but super huge market. I believe in the next 10 years; the licensing industry still has much room for development. As an industry leader in China, VCG is going to keep focusing on our local market while welcome and open to share our experiences, channels and business opportunities with every industry partners around the world.

Thank you very much.